federal unemployment benefits tax refund

Unemployment Compensation - This box includes the dollar amount paid in benefits to you during the calendar year. In the latest batch of refunds announced in November however the average was 1189.

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

It would make tax reporting simpler if you repay the entire amount in 2021.

. All of the federal taxes withheld will be reported on the 2021 return as a tax payment. They dont need to file an amended. You had to qualify for the exclusion with a modified adjusted gross income MAGI of less than 150000.

It will start with taxpayers eligible to exclude up to 10200 of unemployment benefits from their federal taxable income. The total unemployment compensation was 10201 or more. Unemployment compensation is considered taxable income by the IRS and most states thus you are required to report all unemployment income as reported on Form 1099-G on your income tax return.

Dont expect a refund for unemployment. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144. IRS schedule for unemployment tax refunds.

Unemployment Insurance Tax Refund. By Anuradha Garg. You should be mailed a Form 1099-G before January 31 2022 for Tax Year 2021 stating exactly how much in taxable unemployment benefits you received.

The American Rescue Plan Act which Democrats passed in March waived federal tax on up to 10200 of unemployment benefits per person collected in 2020. You may owe additional tax if you did not withhold enough on your unemployment income or you may be owed a tax refund if you withheld too much for both federal and state. Federal Income Tax Withheld - This box.

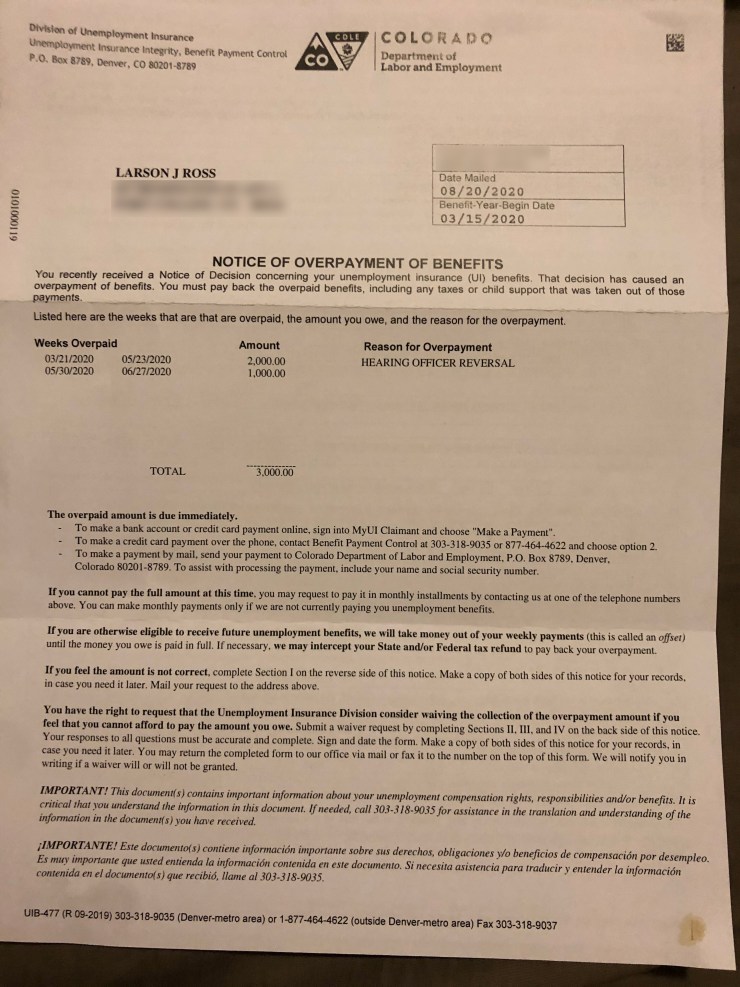

Adjustments - This box includes cash payments and income tax refunds used to pay back overpaid benefits. While taxes had been waived on up to 10200 received in unemployment for those making less than 150000 in 2020 -- the first year of the pandemic -- that was only temporary relief and no such. Most taxpayers will receive their unemployment refunds automatically via direct deposit or paper check.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. The information on the 1099-G tax form is provided as follows. The regular rules returned for 2021.

The second phase includes married couples who file a joint tax return according to the IRS. Is There a Tax Break on Unemployment Benefits Received in Tax Year 2021. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020.

Tax Refunds On Unemployment Benefits Still Delayed For Thousands. For folks still waiting on the Internal Revenue Service. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form 1040 Additional Income and Adjustments to Income PDF.

The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to 10200 of unemployment benefits on their 2020 tax return. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. Congress hasnt passed a law offering.

Billion for tax year 2020. For your W-2 income from employment you may be familiar with withholding via Form W-4. In some cases when Form 1099-G Certain Government Payments information was not available the IRS automatically allowed an exclusion amount of up to 20400 for married individuals who live in a non-community property state and who filed a joint 2020 tax return when.

The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit. The average refund for those who overpaid taxes on unemployment compensation was 1265 earlier this year. Enter the amount of tax withheld from Form 1099-G Box 4 on line 25b of your Form 1040 or Form 1040-SR.

Use the Unemployment section under Wages Income in TurboTax. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. Receiving unemployment benefits does not mean that a federal income tax refund will be reduced.

You will receive back a percentage of the federal taxes withheld based on the amount of unemployment that was repaid in 2021. With the latest batch of payments on Nov. If you paid more than the correct tax amount the IRS will either refund the overpayment or apply it to other outstanding taxes owed.

When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits collected in tax year 2020. In most cases if you already filed a 2020 tax return that includes the full amount of your unemployment compensation the IRS will automatically determine the correct taxable amount of unemployment compensation and the correct tax. Couples can waive tax on up to 20400 of benefits.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. The IRS will issue refunds in two phases. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer.

Insurance benefits last year and electronically filed their 2020 vermont individual income tax returns prior to the federal unemployment tax exclusion passed earlier this year. This is not the amount of the refund taxpayers will receive. You should receive.

That law waived taxes on up to 10200 in unemployment insurance benefits for individuals earning less than 150000 a. President Joe Biden signed the pandemic relief law in March. 22 2022 Published 742 am.

Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. 1 the IRS has now issued more than 117 million unemployment compensation refunds totaling over 144 billion. Unemployment benefits received in 2021 are taxed as ordinary income like wages but are not subject to Social Security and Medicare taxes.

To report unemployment compensation on your 2021 tax return.

1099 G Unemployment Compensation 1099g

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Get A Refund For Taxes On Unemployment Benefits Solid State

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Interesting Update On The Unemployment Refund R Irs

Is Unemployment Compensation Going To Be Tax Free For 2021 Gobankingrates

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

Irs Unemployment Refunds What You Need To Know

States Are Telling Some People To Pay Back Unemployment Benefits Marketplace

State Income Tax Returns And Unemployment Compensation

2021 Unemployment Benefits Taxable On Federal Returns Cbs8 Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Usa