can you go to jail for not paying taxes in south africa

There are different laws in South Africa that regulate the. Web So to answer your question whether youll go to prison for debt in short NO.

Web Janine Myburgh managing director of Myburgh Attorneys responds.

. South African law maintains that no one may be detained without appearing. Web SARS threatens fines and jail time for taxpayers not paying their due. 445 28 votes Can you go to jail for not paying debt in South Africa.

Web Posted 18 June 2021. The penalty is 5 percent of your unpaid taxes for each month your tax return is late up to 25 percent. Web Deliberately not paying or underpaying federal taxes can lead to a prison sentence but only if youve been charged with and convicted of a tax-related crime such.

Web Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. However the state has two codes that deal with tax evasion. Web Simply put in most cases a person will not receive jail time because they owe taxes to the IRS.

The short answer to the question of whether you can go to jail for not paying taxes is yes. If you fail to file and pay taxes youll incur both failure-to-file and. While there is generally a 10-year limit.

Web Published July 26 2022. However failing to pay. Can you go to jail for not paying taxes.

Web Negligent reporting could cost you up to 20 of the taxes you underestimated. Web If you dont file youll face a failure-to-file penalty. It depends on the situation.

Web Technically a person can go as long as they want not filing taxes. However the IRS also has a long time to try and collect taxes from you. Web Absolutely yes you can go to jail for not paying your taxes.

The IRS handbook defines tax evasion as the willful attempt to evade or defeat the assessment and payment of taxes. Well explain in a moment. Failing to file a tax return is a misdemeanor punishable by imprisonment for up to one year in jail.

Web Tax evasion. Plus if you file more than. In the past SARS needed to prove that a taxpayer had committed a tax crime willfully and without just cause but the legislation has just been.

SARS has announced that it will intensify criminal. Imprisoned for up to three years OR. It is possible to go to jail for not paying taxes.

If you failed to file your taxes in a timely manner then you could owe up. Although it is federally illegal to not file a tax return it is extremely. Web May 4 2022 Tax Compliance.

Web An inquiry into this can also lead to jail time if the IRS decides to take a harsher stance based on the actions. Fined up to 250000 for an individual offender or 500000 for a corporation. While you could spend up to six months in jail there are also some fines that you may have to.

You cannot go to jail for not paying your debts when there is a judgment against you. Web The general answer for how long you will spend in county jail for tax evasion in California is one year. Staff Writer 29 September 2017.

Web If convicted you are guilty of a felony and can be. The short answer is yes. Thus there are two kinds of tax.

Web Contribute R75000 instead of R50000 and your tax refund increases to R27000. Whether a person would actually go to.

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Crypto Tax Evasion What Are The Risks In South Africa Koinly

How The Gupta Brothers Hijacked South Africa Using Bribes Instead Of Bullets Vanity Fair

What Happens If You Don T File Taxes For Your Business Bench Accounting

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

What S The Difference Between Tax Evasion And Tax Avoidance

Black Children Were Jailed For A Crime That Doesn T Exist Almost Nothing Happened To The Adults In Charge Propublica

A Guide To Remote Work Taxes Velocity Global

29 Crucial Pros Cons Of Taxes E C

By Imprisoning Jacob Zuma South Africa Has Restored The Rule Of Law

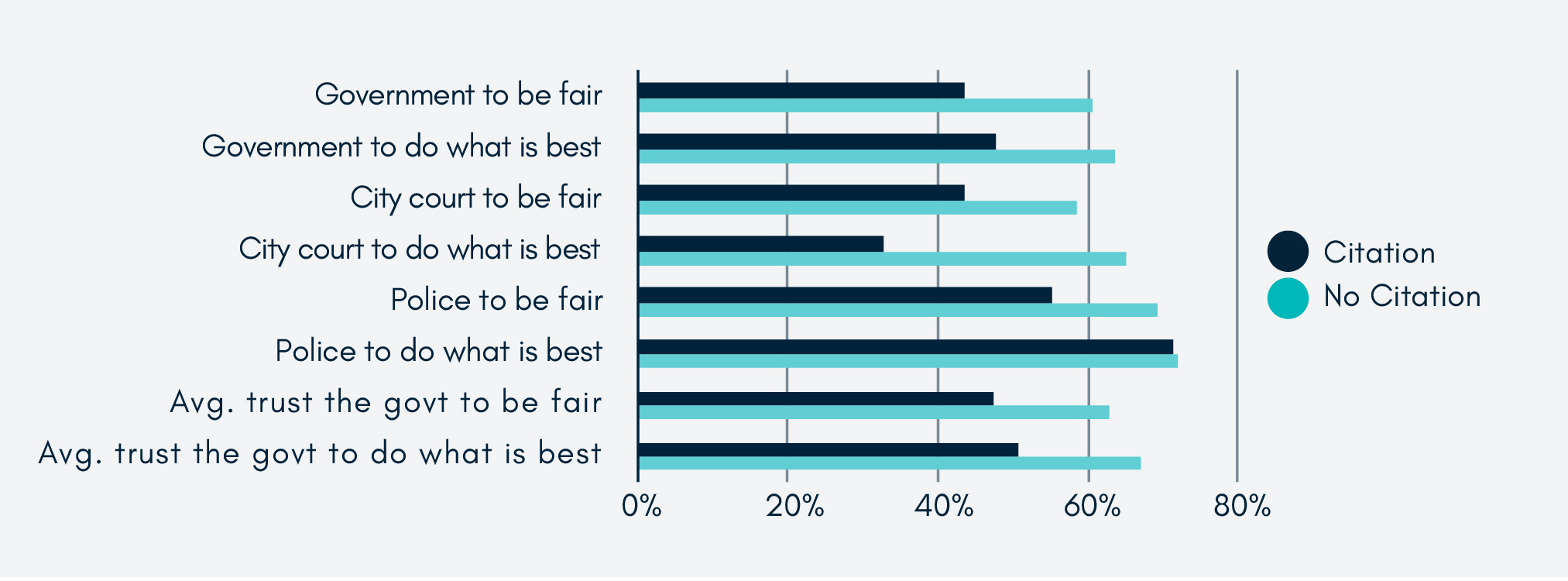

The Price Of Taxation By Citation Institute For Justice

How Not To Pay Taxes Four Legal Ways To Not Pay Us Income Tax

Irs Cares About Tax Evasion No Matter Who You Are Silver Law Plc

Haven T Filed Your Tax Return The Penalties Are Coming Nerdwallet

Irs Audit Penalties And Consequences Polston Tax

Here S What Happens When You Don T File Taxes

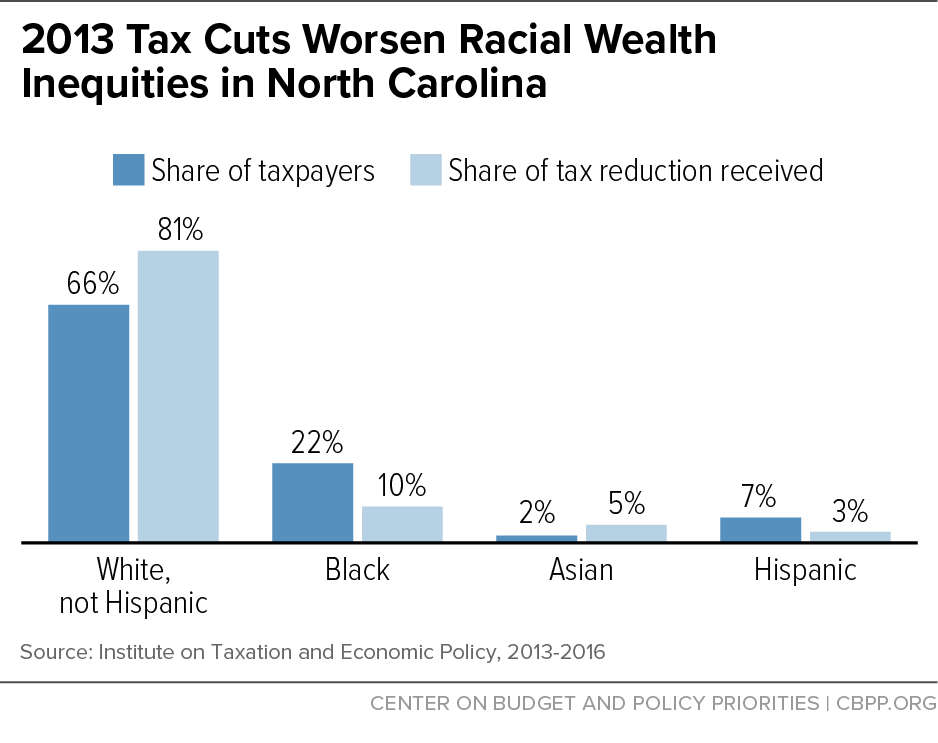

Advancing Racial Equity With State Tax Policy Center On Budget And Policy Priorities

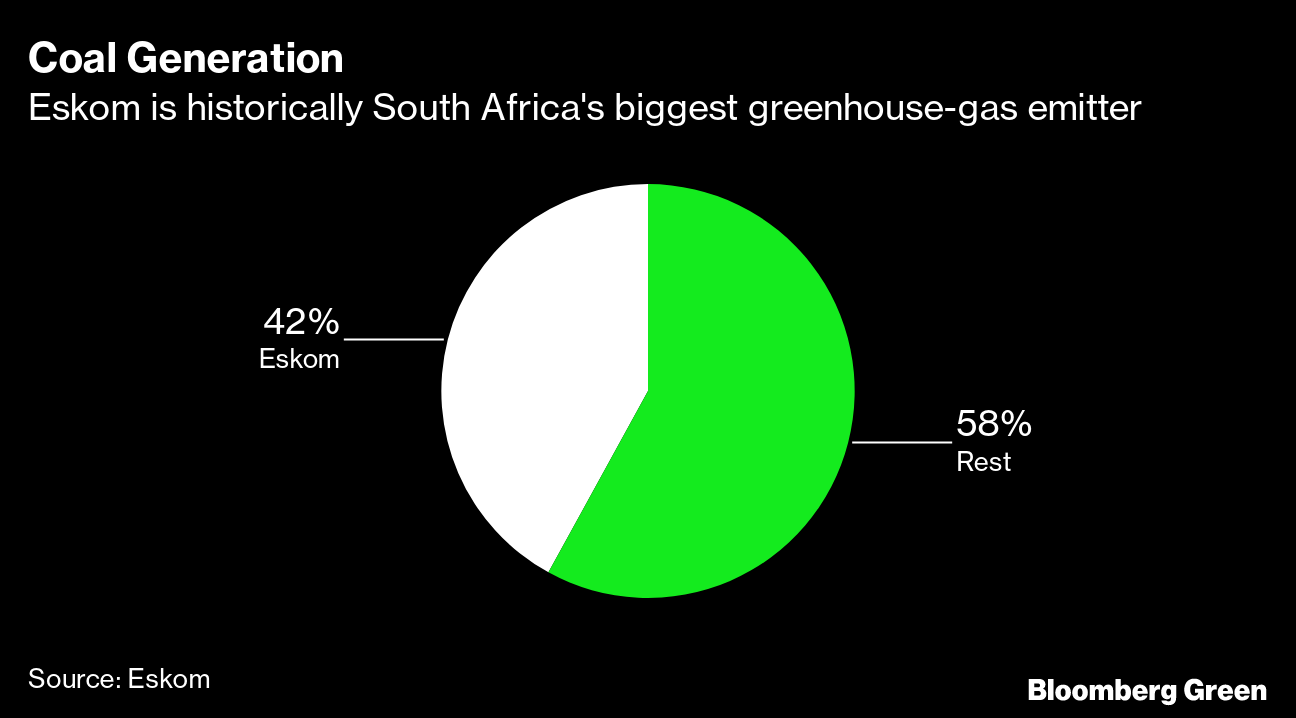

South Africa S 8 5 Billion Climate Funds Sparks Battle Bloomberg